Discover more from The Conscious Consumer

Charts to Chew On: March Madness.

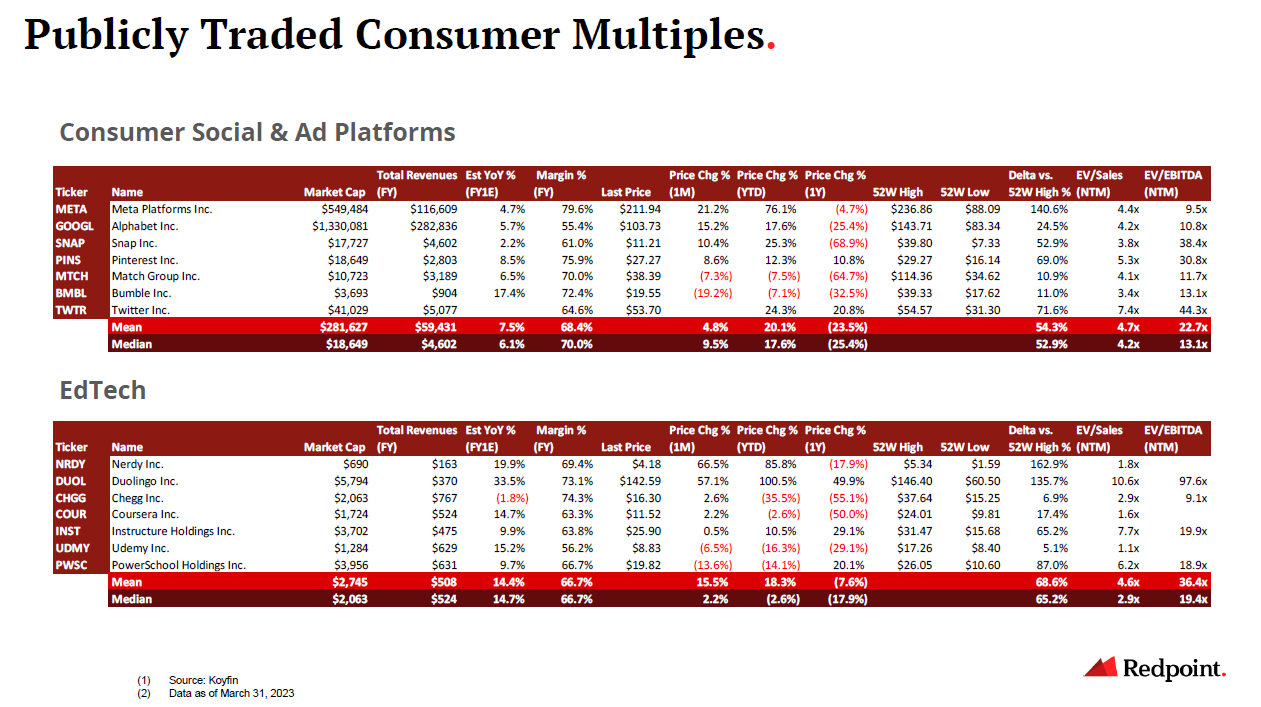

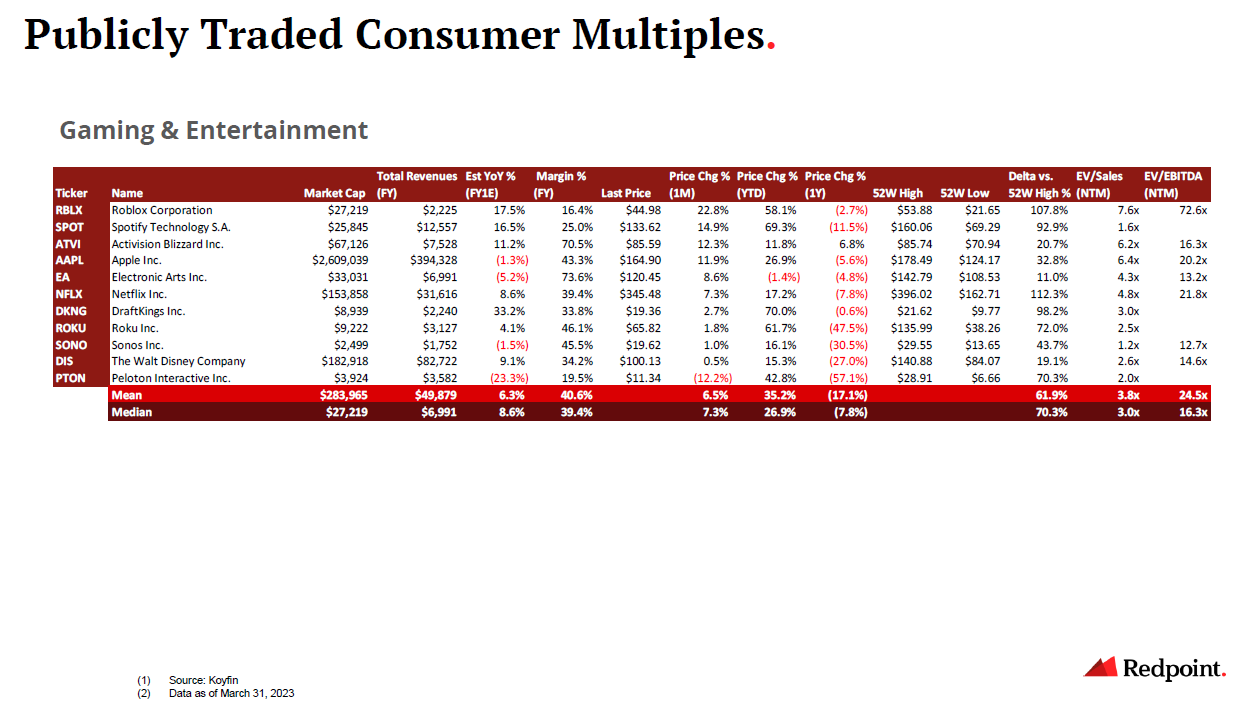

Contextualizing monthly consumer sentiment and market momentum. Data as of March 31, 2023.

For those who are newer here, I publish monthly readouts on the state of the markets and the corresponding implications for the US consumer. Read on for more!

Perhaps the only thing more surprising than the series of upsets defining this year’s men’s and women’s March Madness tournaments is the economic uncertainty initially ignited by the collapse of Signature Bank and SVB that has since taken over headlines, board rooms, and policy agendas, sending ripple effects across global financial markets. As March ushered in the biggest US banking crisis since 2008, the collapse set off a scramble across asset classes with the path to quality – and what the term even means vis a vis today’s macro backdrop – appearing murkier by the day.

While rates swiftly dropped close to three quarters of a percent in response, equities showed less confidence in ascertaining the overall impact of these events with the market closing the month constructively up 3.5% despite moving >1% higher 26% of trading days and dropping >1% on 22% of trading days, highlighting the underlying uncertainty of it all. While the Fed, seemingly espousing a similar lack of conviction, sheepishly raised rates an additional 25bp, it left itself with increasing wiggle room to reverse course on its relentless rate hikes in upcoming policy meetings. The market all but views this as a guarantee, with Fed swaps now pricing in expectations for 2 rate cuts by year end as calls for increasing accommodation grow by the day. Yet, this likely doesn’t tell the full picture.

While I indeed hope that the literal tornadoes are behind us (and my thoughts go out to those impacted by these accelerating climate events…), my suspicion is that the metaphorical whirlwinds are likely to only pick up momentum from here. With the reactive tightening of financial conditions in response to the global financial volatility now leading to increasing conjecture surrounding a looming credit crunch, consumers and corporates alike appear poised to face a far more challenging borrowing environment as banks take a more conservative approach in the face of whipsawing deposit bases and a potential uptick in mandated liquidity requirements.

So, what does this mean for the US consumer? And do these Roaring Twenties appear likely to mirror their predecessors in more than just their social stamina? While too early to tell with so much of our publicly available data reflecting a pre SVB reality that at this point feels like a distant memory, I would go so far as to say that we are likely to face tough times ahead. Though overall unemployment still sits just off record lows and consumer spending remains resilient based on the commentary out of Q4 earnings, the evaporation of liquidity could mean that the coming quarters feel more like a drought than the economic oasis of the past decade. With debt today serving as our fuel for the future – whether it’s enabling a consumer to buy their first home, a family-owned business to scale its footprint, employee base, and operations, or a startup to save us from the growing list of challenges facing humanity – it’s played an integral role in our underlying economy and one that few remember ever living without. Moving forward, I suspect we’ll see a softening of the employment landscape, a reset in prices across asset classes, and a re-emphasis on foundational needs (yes, I’m back with more Maslow-driven musings) as we navigate the new normal ahead.

Moving into Q2 (can you believe we’ve made it?!), eyes and ears will be on high alert as entrepreneurs, investors, and everyday individuals alike look towards upcoming economic data and regulatory releases to instill confidence in our increasingly shaky system.

Note: Data reflective of March 31, 2023. This does not constitute investment advice.

As a big believer in kaizen, I’m always open to feedback. Whether it’s names to include or formats to explore, please help me help you! Subscribe to my Substack or find me on Twitter at @itsmeeraclark.