Discover more from The Conscious Consumer

Charts to Chew On: An Ominous October.

Contextualizing monthly consumer sentiment and market momentum. Data as of October 31, 2022.

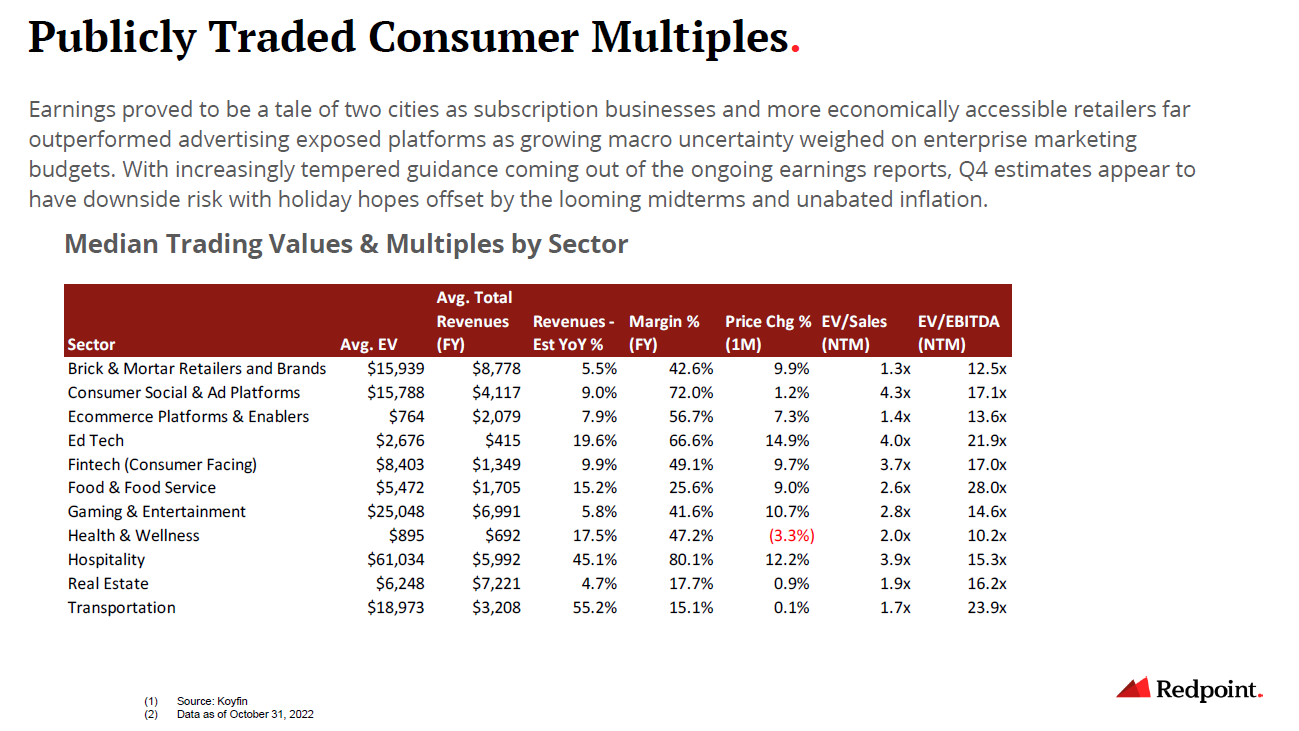

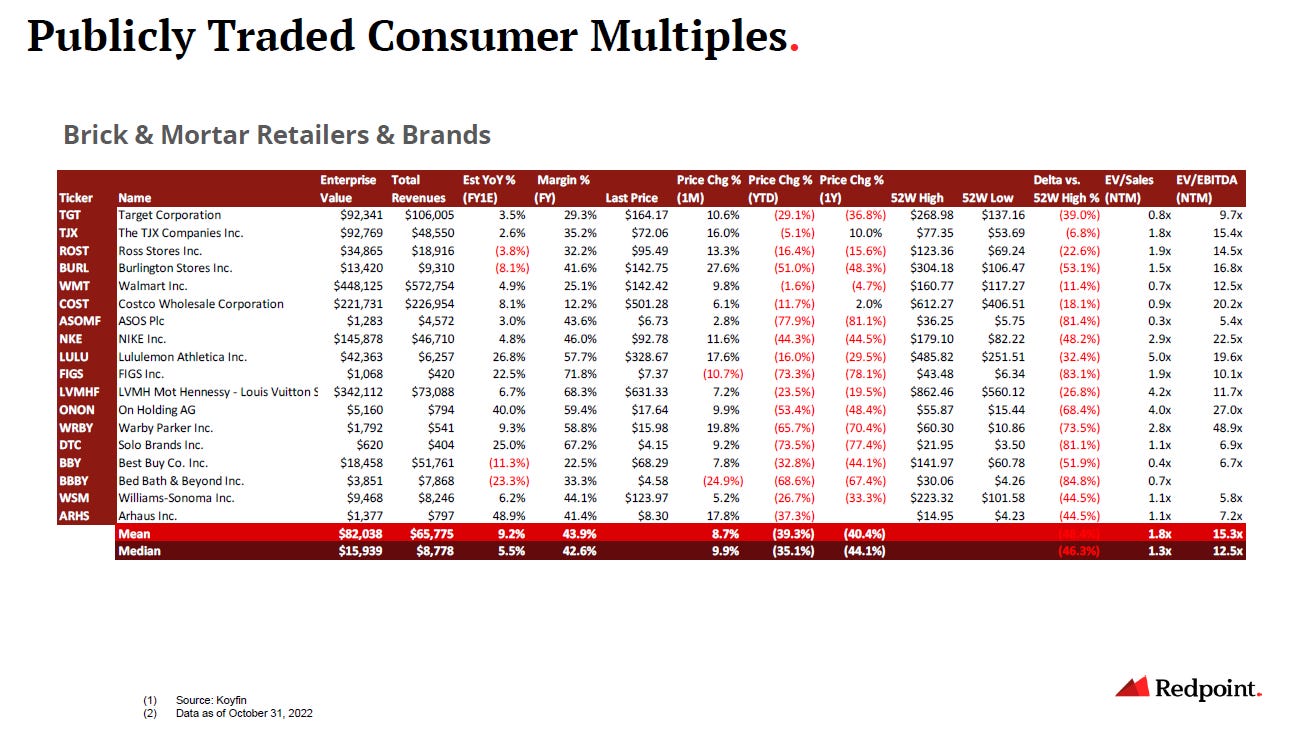

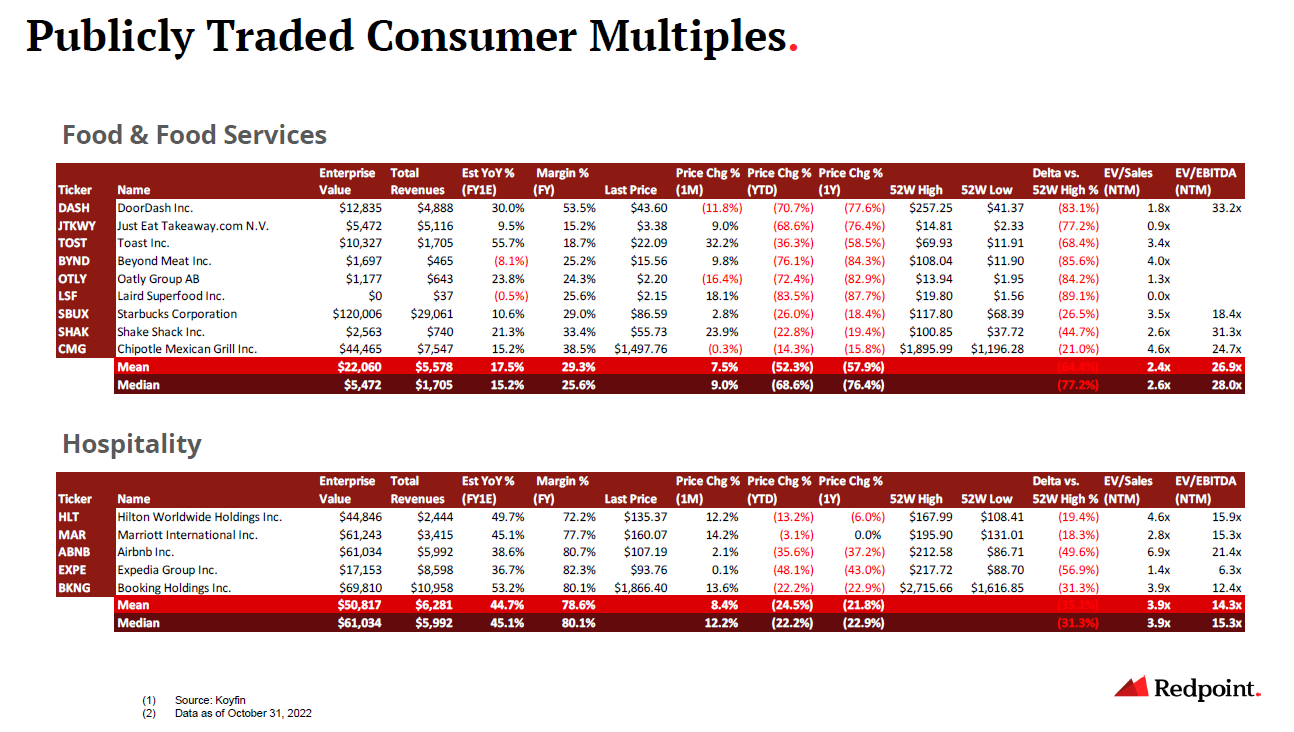

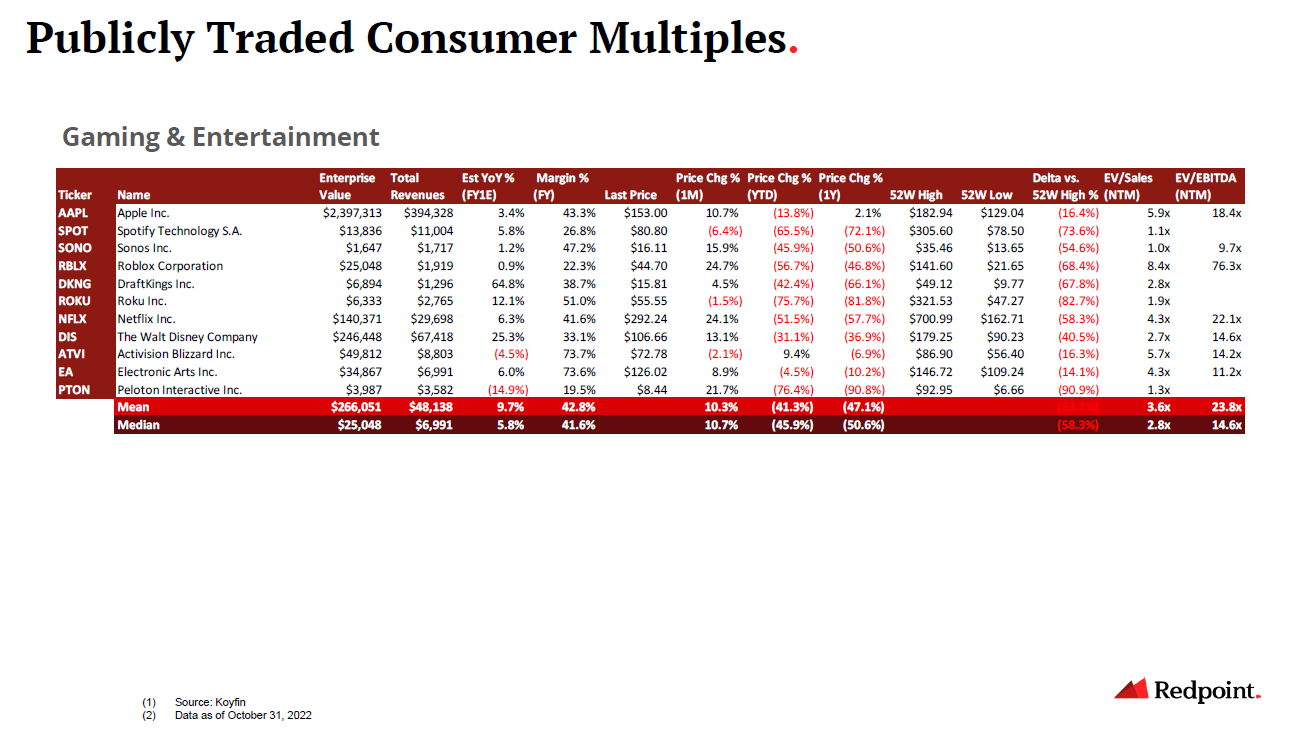

With Halloween tales of terror haunting kids far and wide, the market seemed not far behind with spooky surprises (or least dreaded realizations) mounting on the macro front by the day. While markets closed the month well in the green with the Dow posting its best monthly return since 1976 (!), sentiment was more reflective of the soggy pumpkins still populating porches nationwide — unable to deny deteriorating conditions yet unwilling to let go of the sugar and stimulus-driven exuberance of good times past. We enter the final two months of the year facing a tenuous juxtaposition. While (almost) all signals, ranging from durable goods orders to weakening home prices, are now blaring red, consumers appear to be quite comfortable living in dogmatic denial as spending behavior, travel intentions, and record low unemployment continue to paint a rosy picture of what could be. With November and December marking two of the best historical trading months of the year with a combined average return of +3%, optimists are hoping that Christmas will indeed early. So might we, for the first time in the three years since COVID turned our world upside down, finally welcome in a holiday season marked by hope, joy, community, and the promise of prosperity around the bend? Or will stocks and broader sentiment simply continue to be squashed by the macro backdrop Scrooge?

Note: Data reflective of October 31, 2022. This does not constitute investment advice.

As a big believer in kaizen, I’m always open to feedback. Whether it’s names to include or formats to explore, please help me help you! Subscribe to my subscribe to my Substack or find me on Twitter at @itsmeeraclark.