Discover more from The Conscious Consumer

Charts to Chew On: An Anxious August.

Contextualizing monthly consumer sentiment and market momentum. Data as of August 31, 2023.

For those who are newer here, I publish monthly readouts on the state of the markets and the corresponding implications for the US consumer. Read on for more!

Stocks stumbled a bit in August as both the S&P 500 and NASDAQ posted their first monthly declines since February. The S&P 500 dropped almost 2%, bringing its year-to-date gains down to 17%, while the NASDAQ dropped over 2%, bringing its year-to-date gains down to 34%. The mover lower came as little surprise, with August historically showing the third weakest month of performance for US indices.

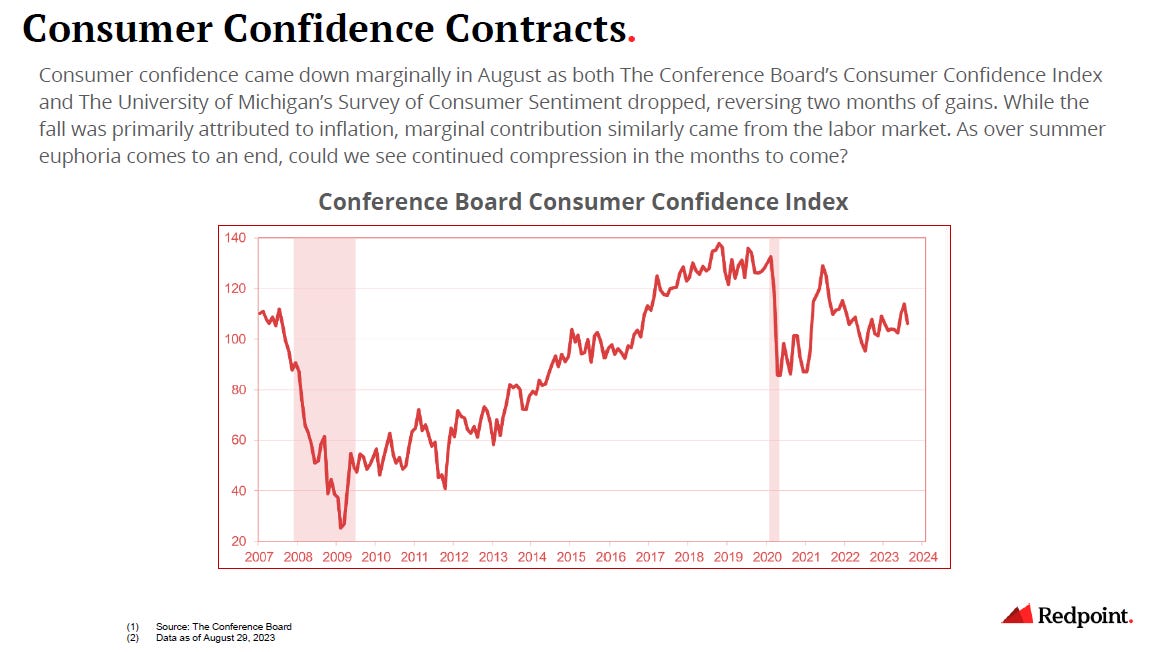

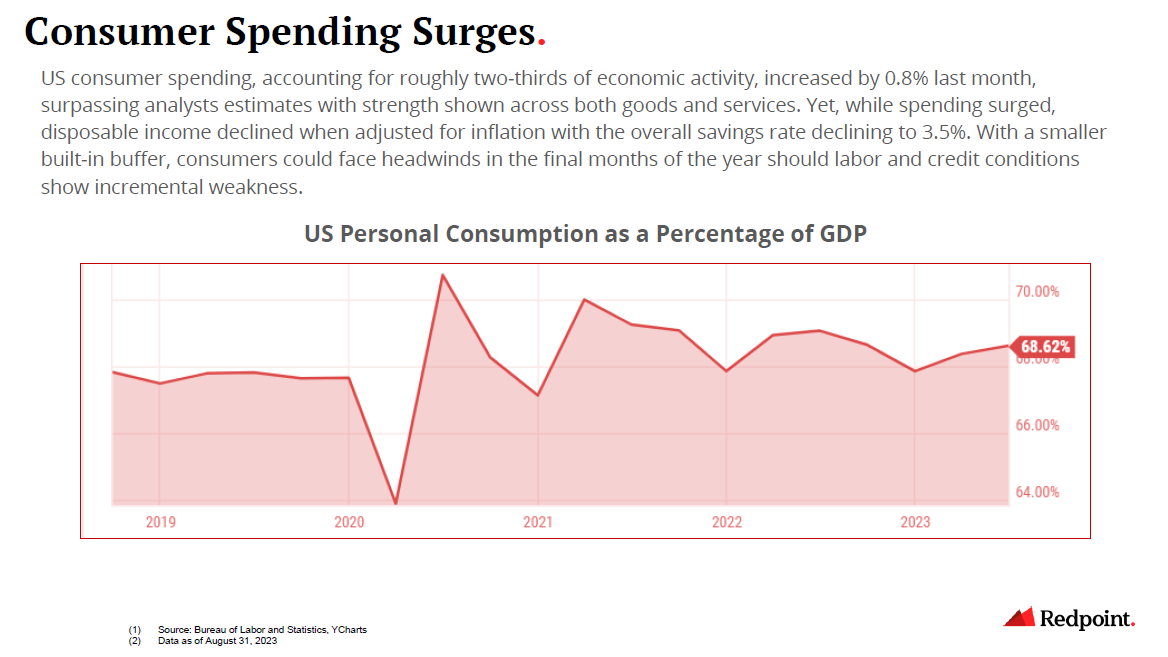

Albeit a quieter month for news flow, August showed sequential support for the aspirational soft-landing narrative. While labor levels seemingly normalized, consumer spending remained strong but not euphoric. As overall inflation levels continue to normalize and approach the Fed’s 2% target, optimists continue to opine that we just might be averting the recession that was almost universally expected earlier this year.

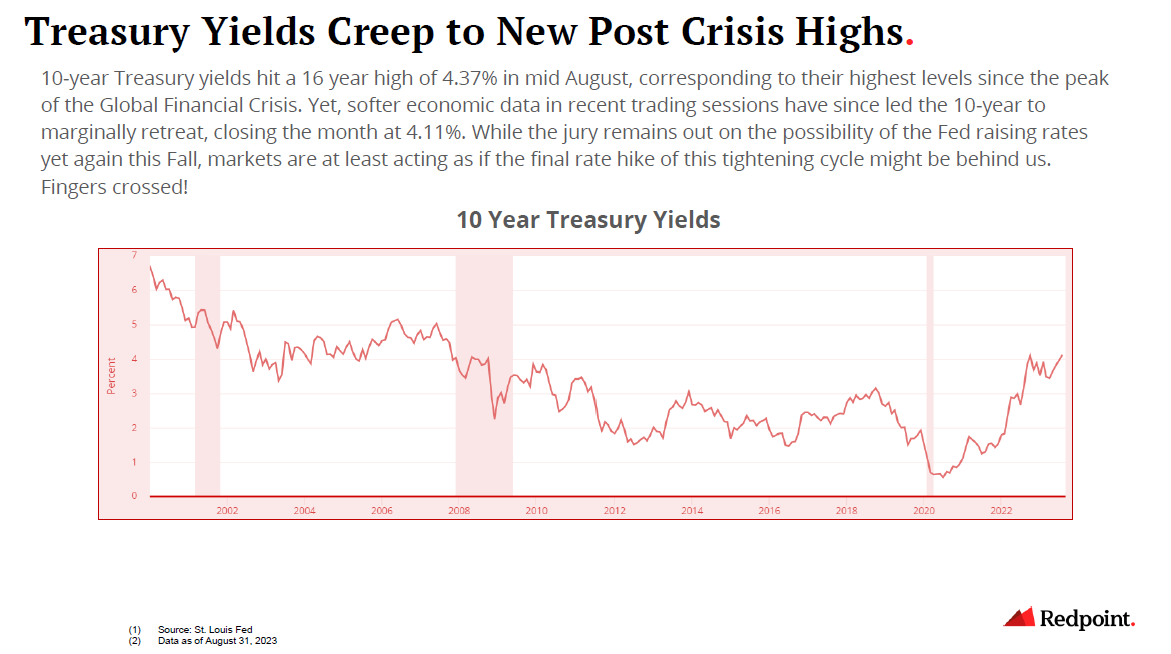

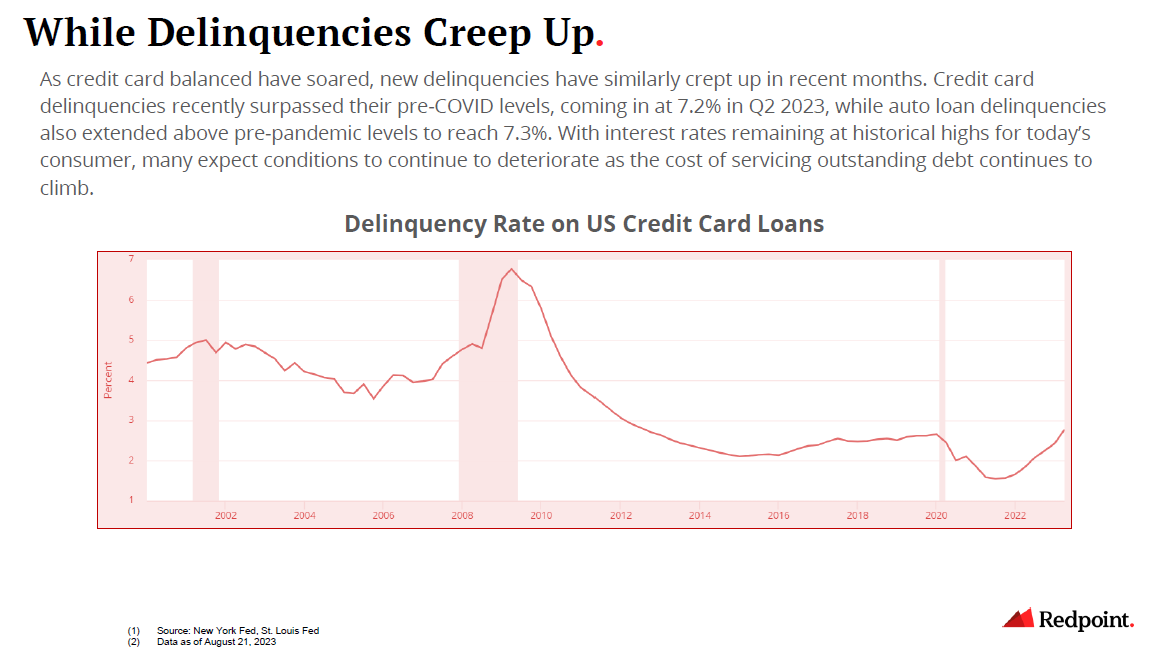

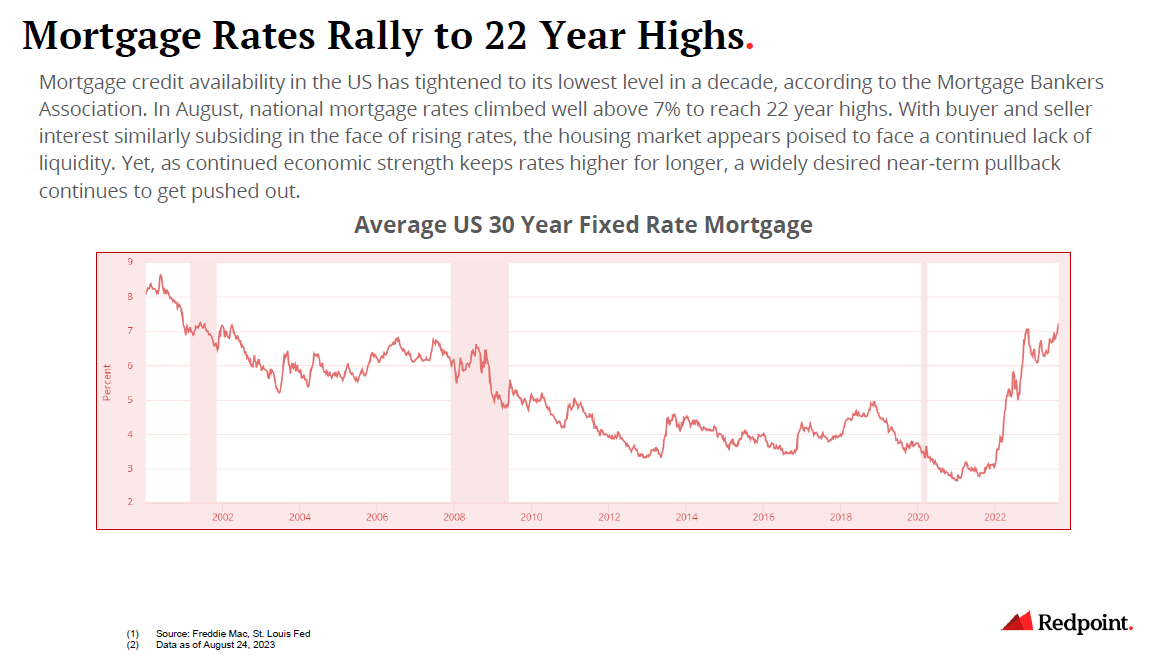

Yet, while by many indications market conditions remain relatively constructive, the month was not without its knocks. The US’s credit rating was downgraded a notch (AAA to AA+) by Fitch, while weakness across almost all corners of the Chinese economy have led to mounting concerns surrounding global growth prospects. And as ongoing Fed chatter surrounding the potential rate path ahead led to bumps across the bond market, a significant selloff over the course of the month drove 10-year yields well above 4% and up to pre–Financial Crisis highs.

With September historically serving as the worst month of the year for US equities, investors coming back from the long weekend are buckling up for what could be turbulent times. So, as you make similarly sense of the setup from here, please enjoy a selection of data points below.

Note: Data reflective of August 31, 2023. This does not constitute investment advice.

As a big believer in kaizen, I’m always open to feedback. Whether it’s names to include or formats to explore, please help me help you! Subscribe to my Substack or find me on Twitter at @itsmeeraclark.