Charts to Chew On: A September to Remember.

Contextualizing monthly consumer sentiment and market momentum. Data as of September 30, 2022.

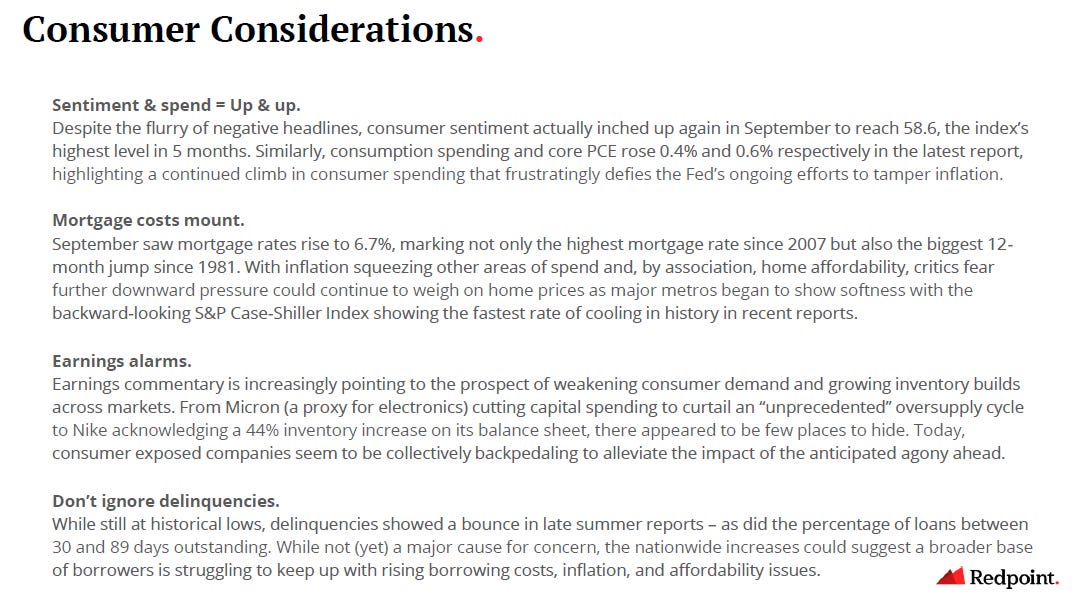

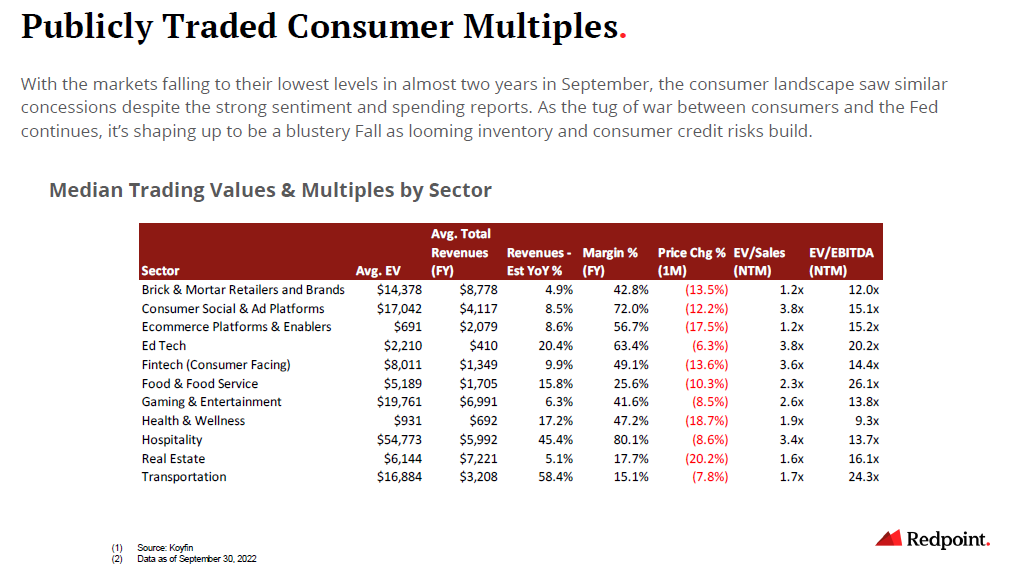

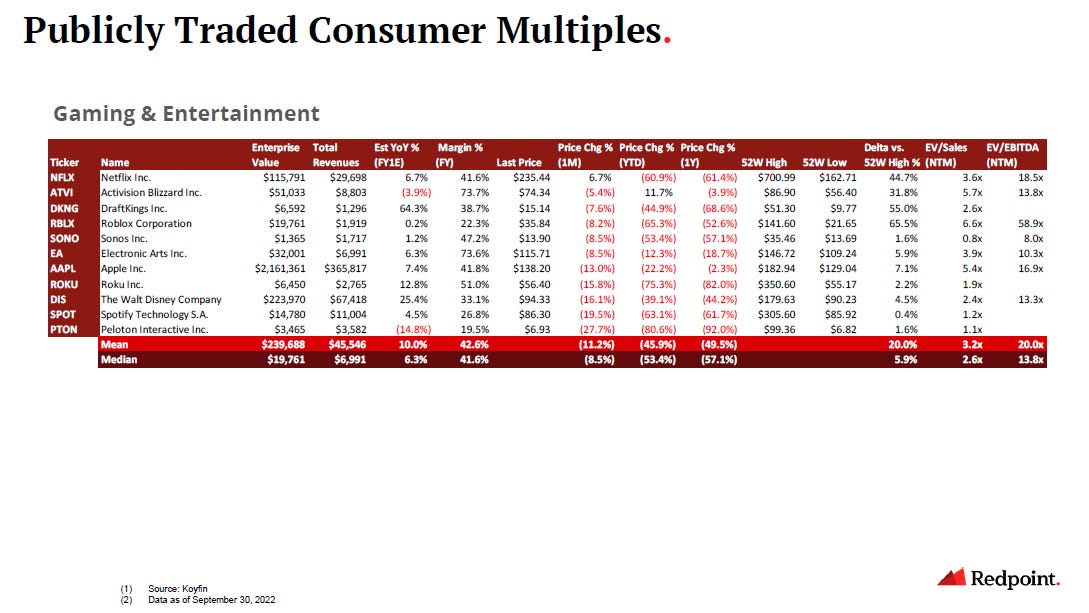

In the US, the market’s September storms seemingly amplified the quintessential back-to-school mentality, with participants kicking and screaming. Battered by rates’ continued climb, Fed fueled fears surrounding surging unemployment, and a rising risks of recession, the S&P tumbled to end the month at 22 month lows. Furthermore, with a divergence in global approaches as the hawkish Fed and European Central Bank now position themselves in contrast to the dovish Bank of England and Bank of Japan, the list of concerns surrounding the global market’s attempt to avert a global economic crisis seems to be growing. As markets enter the final quarter of the year (a period that has averaged roughly a +5% return in recent decades), investors are bracing themselves for what could quite feasibly be the wildest ride — at least from a volatility perspective — of the year.

Note: Data reflective of September 30, 2022. This does not constitute investment advice.

As a big believer in kaizen, I’m always open to feedback. Whether it’s names to include or formats to explore, please help me help you! Subscribe to my subscribe to my Substack or find me on Twitter at @itsmeeraclark.